July 10, 2025

July 10, 2025

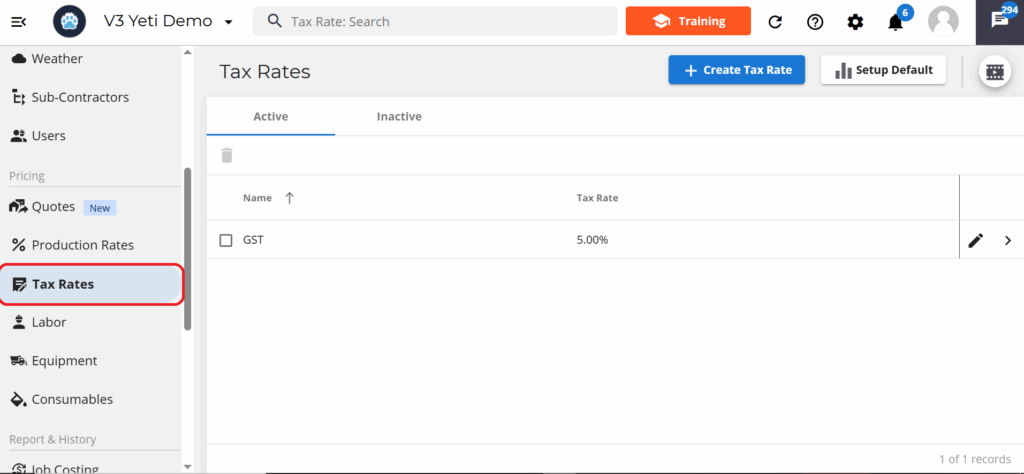

Tax Rate Guide

Create and manage tax rates for different regions. Apply them to items such as consumables, equipment, and labour, or exempt specific items from taxation

Important Note: These rates apply only to your quotes. They do not affect your billing, which is pushed to QuickBooks Online (QBO) based on the settings configured in your Company Settings in Yeti.

Table of Contents:

Add a New Tax

Select the tax rate button on the navigation bar.

Select the Create Tax Rate button to add a new rate.

Enter a name and a rate percentage for the tax.

If you need to add more than one tax, click Add another tax button.

Select save when you are done.

Setting Up Default Tax

To assign default tax rates to items like equipment, consumables, and labor, click the Setup Default button.

A pop-up will appear with a list of items and dropdown menus next to each one. For each item, select a tax from the dropdown or choose Exempt if you don’t want to apply a tax.

Select save once you are done.

Archiving Tax Rates

To archive a tax rate, select the checkbox beside the tax rate you want to archive, then click the bin icon. The tax rate will move to the Inactive tab.

Unarchiving Tax Rates

To unarchive a tax rate, go to the Inactive tab, select the checkbox beside the tax rate you want to restore. Then click the bin icon. This will move the rate back to the active tab.